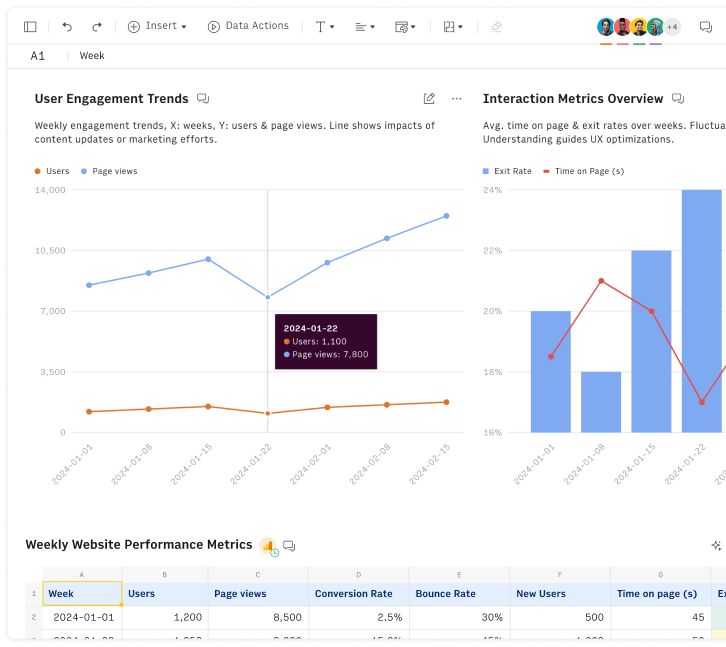

The Days sales outstanding (DSO) calculator allows you to measure the average number of days it takes a business to collect payment from its customers for the products or services sold. It is calculated by multiplying the portion of sales not yet cashed in, a current asset account called Account Receivables, in a given period - usually a year - by the number of accounting days in that period - usually 365.

Input required:

Account receivables(Beginning of the period)

Account receivables(End of the period)

Total sales

Accounting days

DSO = Average(Account receivablesEOP,Account receivablesBOP)/Total sales * Accounting Days

Practical example:

Account receivables(Beginning of the year) | 40.000$ |

Account receivables(End of the year) | 20.000$ |

Total sales | 250.000$ |

Accounting days | 365 |

DSO = Average(40.000$,20.000$)/250.000$ * 365 = 49

This means that the business takes, on average 49 days to collect its invoices. The National Summary of Domestic Trade Receivables by the Credit Research Foundation (CRF) revealed that the median DSO for various industries in Q3 of 2021 was 37.69 days. In general, any DSO below 45 days is considered good.

Monitoring DSO is crucial for businesses because it provides insights into their cash flow and liquidity position. A high DSO indicates that the business is taking longer to collect payments, which can result in cash flow issues and limit the ability to invest in growth opportunities.

There are several strategy one business can adopt to improve its DSO:

Invoice visibility By providing customers access to their current and past invoices, they will have a better understanding of what they owe and when payment is due.

Accept digital payments Digital payments can lead to faster payment collection and eliminate the unpredictability of mail delays. B2B customers are increasingly favoring digital payments due to their convenience.

Offer discounts for early payments Discounts for early payments can incentivize customers to pay sooner. However, tracking discount eligibility and application can be a hassle. Accounts receivable automation software can simplify the process by tracking discounts and credits and reconciling changes in the financial management system.

Automate reminders Automating payment reminders can increase the likelihood of receiving payment on time. Personalized notifications can be automated, which eliminates the need to send dunning letters or emails. This approach can also preserve customer relationships by avoiding confrontational calls. Check our SEND_EMAIL function out to learn how to automate emails from your spreadsheets.

Evaluate customer creditworthiness regularly Regular evaluations of customer creditworthiness can identify at-risk customers early on. If a customer consistently pays late, it may be necessary to stop extending payment terms. This approach can help maintain the health of cash flow by taking action to bring at-risk customers back on track or walk away.